- Home

- Forex Brokers Deep Reviews

- XM DETAILED REVIEW

- VT MARKETS DETAILED REVIEW

- MOOMOO DETAILED REVIEW

- VANTAGE DETAILED REVIEW

- TRADE 360 DETAILED REVIEW

- TRADE NATION DETAILED REVIEW

- TOP FX DETAILED REVIEW

- TMGM DETAILED REVIEW

- TICKMILL DETAILED REVIEW

- PLUS 500 DETAILED REVIEW

- PEPPERSTONE DETAILED REVIEW

- AMARKETS DETAILED REVIEW

- MONETA MARKETS DETAILED REVIEW

- IG DETAILED REVIEW

- REVOLUT DETAILED REVIEW

- HYCM DETAILED REVIEW

- IRON FX DETAILED REVIEW

- LITE FINANCE DETAILED REVIEW

- EASY MARKETS DETAILED REVIEW

- TASTY WORKS DETAILED REVIEW

- FP MARKETS DETAILED REVIEW

- EIGHTCAP DETAILED REVIEW

- Capital.com DETAILED REVIEW

- Octa FX DETAILED REVIEW

- AVATRADE DETAILED REVIEW

- HFM DETAILED REVIEW

- Just Forex DETAILED REVIEW

- FXTM DETAILED REVIEW

- INSTA FOREX DETAILED REVIEW

- AXI DETAILED REVIEW

- FX Primus DETAILED REVIEW

- FX Open DETAILED REVIEW

- FBS DETAILED REVIEW

- Exness DETAILED REVIEW

- ICMARKETS DETAILED REVIEW

- Daily News & Blog

- Complete Guides for Traders

- Forex Market

- Shop

- White Label Solution

- About Us

- Motivational Videos

- Trading Memes

EASY MARKETS DETAILED REVIEW

0.0 out of 5 stars (based on 0 reviews)

There are no reviews yet. Be the first one to write one.

What is EasyMarkets?

EasyMarkets is a Cyprus-based forex trading firm that started its operation back in 2001 and was one of the first to offer online trading at their developed user-friendly platform. The company strives to deliver trustful trading conditions in response to market volatility with fixed spread and no slippage, thus the traders always know their costs. easyMarkets offices are located in Shanghai, Sydney, and Limassol (Cyprus), as well as the Marshall Islands, to be able to offer services globally and provide personal customer service.

The company started with a simple idea: democratize trading by offering low-cost deposit amounts, so that it’s accessible to everyone. They started with an initial deposit of only 25$, but over time, as they expanded their client base, their range of instruments also grew to include Forex instruments, global indices, energies, metals.

The official website of the Forex Broker easyMarkets

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

Is EasyMarkets a market maker?

As a market maker, Easy Markets makes money from the bid-ask spread, which is the difference between the price at which a broker offers to buy securities and the price at which it offers to sell them.

EasyMarkets Pros and Cons

EasyMarkets is a Forex and CFD broker that offers its services in several countries.

easyMarkets provides easy account opening, a wide range of instruments, good education and research tools, also platform selection. Fees and spreads are mainly in line with the industry average. The minimum deposit offered by the broker is also average for the industry. Overall, our experience with easyMarket can be considered positive.

The only downside we found was that easyMarket has no 24/7 support and its instrument range is limited to Forex and CFDs.

| Advantage | Disadvantage |

|---|---|

| Multiply regulated broker with a strong establishment | Only Forex and CFDs |

| Ggreat technical solutions, tools, platforms | No 24/7 support |

| Good Reputation | Conditions vary based on entity |

| Quality education | |

| Negative balance proteciton | |

| Regulated by ASIC and CySEC | |

| Competitive trading conditions |

EasyMarkets Review Summary in 10 Points

Headquarters Headquarters |

Cyprus |

Regulation Regulation |

ASIC, CySEC, FSC |

Instruments Instruments |

Forex instruments, global indices, energies, metals and cryptocurrencies including Bitcoin, Ripple and Ethereum. |

Platforms Platforms |

MT4, WebTrader, Mobile App |

EUR/USD Spread EUR/USD Spread |

1 pip |

Demo Account Demo Account |

Provided |

Minimum deposit Minimum deposit |

$100 |

Base currencies Base currencies |

USD, EUR |

Education Education |

Education and research included |

Customer Support Customer Support |

24/5 |

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

Overall EasyMarkets Ranking

Easy Markets is a broker that offers a safe and secure trading environment. It is regulated by top-tier regulators, and it also provides negative balance protection in case of insolvency. The broker has a good selection of educational tools for beginners, which make it highly attractive for new traders. The main disadvantage of Easy Markets is the limited market range and lack of 24/7 support.

- easyMarkets Overall Ranking is 8.3 out of 10 based on our testing and compared to over 500 brokers, see Our Ranking below compared to other industry Leading Brokers.

| Ranking | easyMarkets | Interactvie Brokers | FP Markets |

|---|---|---|---|

| Our Ranking |     |

|

|

| Advantage | Fees | Insturments | Low Spreads |

EasyMarkets Alternative Brokers

Despite all the benefits and good trading conditions, we found some disadvantages of easyMarkets. The broker’s market range is strictly limited to FX and CFDs with differing conditions for different jurisdictions. Also, international trading seems to be done through its offshore entity which is a major drawback in our opinion.

- Interactive Brokers – Good for Real Stock trading

- FP Markets – Good for low spreads trading

- BalckBull Markets – Excellent for High Leverage trading

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

Awards

EasyMarkets has proven itself as a reputable and favorable broker, and it has received multiple awards and good reviews from both clients and market experts. The broker has gained more and more recognition across the globe over the years, and it has also won several awards for its operation. Here are some of the most notable awards EasyMarkets has received recently:

Is EasyMarkets safe or scam?

EasyMarkets is a safe trade because it follows high regulatory standards and is registered in a few regulated entities in its established jurisdiction. The broker is not a scam, either, as it has been operating since 2011 and has never been accused of fraudulent activity.

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

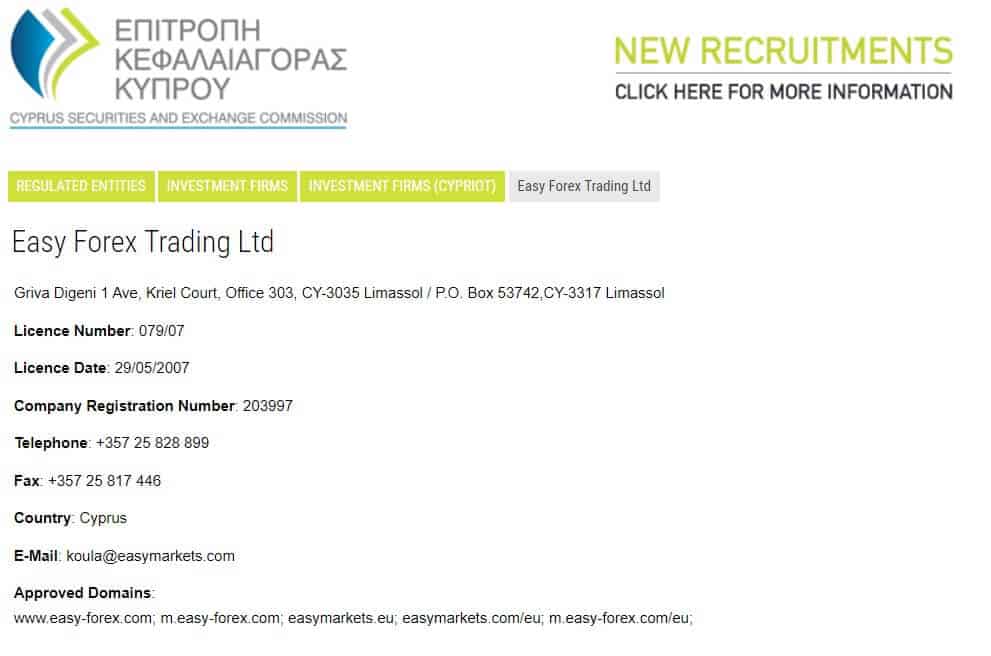

Is EasyMarkets regulated?

The company’s trading name is Easy Forex Trading Limited, it is a Cyprus-established financial services firm with registration number HE203997 regulated by CySEC in Europe that complies with the MiFID set of rules. This means its operation standards enabled the EU to provide legal services to the EEA zone clients and beyond.

EasyMarkets office is also located in the Marshall Islands that in fact does not regulate financial firms, but since it is regulated by the ASIC in the Asian Pacific Region and is Australia Forex Broker that enables authorized trading services.

| easyMarkets Strong Points | easyMarkets Weak Points |

|---|---|

| Multiply regulated broker with a strong establishment | Regulatory standards and protection vary based on the entity |

| Regulated by ASIC and CySEC | Runs offshore entity |

| Founded in Cyprus | |

| Negative Balance protection |

EasyMarkets is committed to its clients’ safety, security, and transparency.

As a regulated financial service provider, EasyMarkets has always maintained the utmost levels of security for its clients’ funds. This includes client money segregation and participation in a scheme in case of insolvency. The company also adheres to strict operational standards that are constantly audited as part of its regulatory commitment

.

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

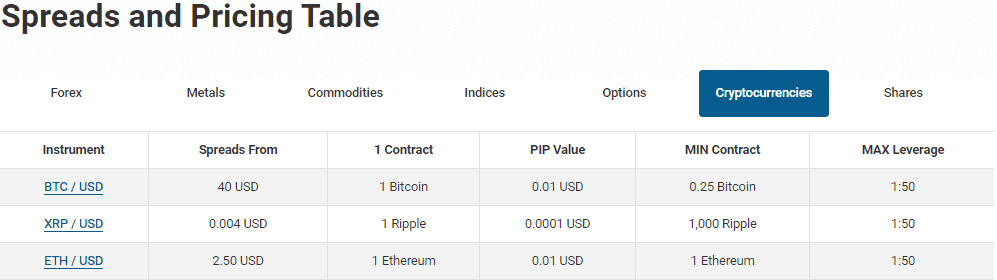

What leverage does easyMarkets offer?

EasyMarkets offers traders a wide range of products and instruments to trade with. By trading numerous instruments, you can use powerful tools such as leverage. Leverage multiplies initial account balances, which may increase your potential gains through its possibility to multiply initial accounts balance.

Yet, make sure to learn how to use tools smartly, as high leverage and incorrect use increase risks as well. As for the easyMarkets leverage levels, as always they are depending on the instrument you trade or platform you use and are also defined by regulatory restrictions.

- Therefore, trading with Australian and global entities regulated by ASIC you can use high leverage with a maximum of 1:400 for major currencies and 1:50 for cryptocurrencies.

- European entity regulated by CySEC demands significantly lower levels due to ESMA restrictions, which offer only 1:30 for Forex instruments and 1:10 for Commodities.

Account types

Our research has shown that easyMarkets offers three types of trading accounts, each with conditions that have been developed over almost two decades of experience and designed to cover the needs of individual traders.

Regardless of the account type you open, make sure to check with customer service to find out what conditions apply to you, as conditions may vary according to your trading entity.

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

EasyMarkets Trading Instruments

The Market Explorer gives deep market insight, showing the real-time rates of 200+ instruments available to trade.

Furthermore, the democratic strategy offers also negative balance protection that is a very useful tool for any type of trader as well as continuous innovation of the easyMarkets delivers valuable trading tools and conditions such as free guaranteed stop loss, inside the viewer, Freeze Rate and very advanced tool deal cancellation. All that ensures the traders’ safety, especially to those who trade in volatile conditions.

EasyMarkets Markets Range Score is 7.9 out 0f 10 for wide trading instrument selection, however, they are limited to FX and CFDs only. Besides, the range might vary according to each jurisdiction

Fees

Our trading fees are included in the fixed spread, and we don’t charge commissions. All accounts include daily emails with technical analysis and fundamental data, as well as guarantees on stop loss, negative protection, and additional trading tools.

EasyMarkets Fees are ranked low with an overall rating of 8.7 out of 10 based on our testing and compared to over 500 other brokers. Fees might vary based on the account type and jurisdiction, but overall our impression is positive—see our finds of fees and pricing in the table below:

| Fees | easyMarkets Fees | Alvexo Fees | FXOpen Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Low |

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

EasyMarkets Spread

We compared the spreads across a wide range of major currencies, including the EUR/USD and GBP/USD. easyMarkets has the most competitive pricing available with its VIP account, which requires a $2 500 deposit ($100 for EU and UK residents) as well as a web platform. The fixed spreads are 0 .77 pips on EUR/USD when using MT4 or the website respectively.

EasyMarkets’ spreads are ranked low with an overall rating of 8.9 out of 10 based on our testing comparison to other brokers. We found that the broker has relatively low spreads offering 0.77 pips for both accounts. Other spreads are attractive as well. easyMarkets spreads see the comparison table below

| Asset | easyMarkets Spreead | Alvexo Spreead | FXOpen Spread |

|---|---|---|---|

| EUR USD Spread | 1.3 pips | 1.4 pips | 0.5 pips |

| WTI Crude Oil Spread | 4 | 4 | 13 |

| Gold Spread | 40 | 35 | 11 |

EasyMarkets rollover

When you trade with easyMarkets, it’s important to keep a few things in mind. One of them is the rollover or overnight fee, which is charged on positions held longer than one day. This can be checked directly from the platform. Each instrument has a different condition for overnight positions and may be as a fee or refund.

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

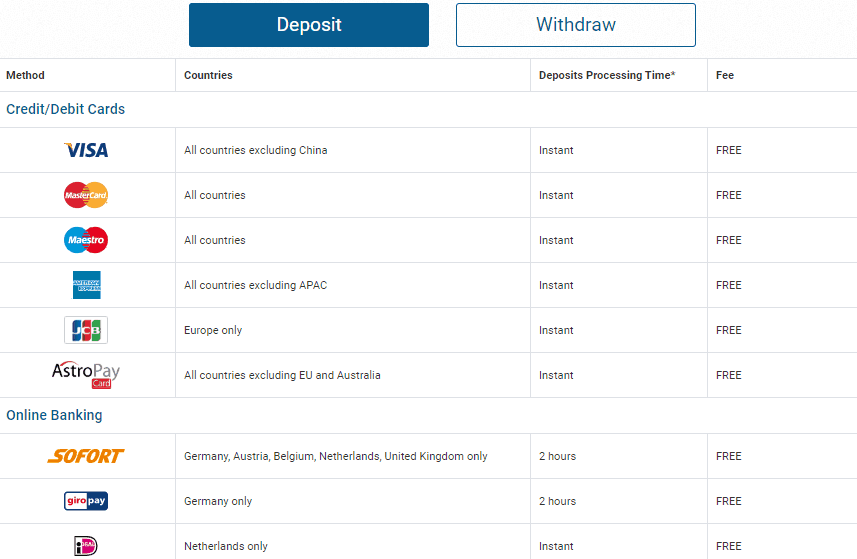

Deposits and Withdrawals

EasyMarkets is one of the easiest brokers to fund your account, with a smooth and straightforward process that is available through their client area. We ranked easyMarkets Funding Methods Excellent with an overall rating of 8 out of 10. The minimum deposit is among the average in the industry, fees are little to no for various currency-based accounts.

Here are some good and negative points for easyMarkets funding methods found:

| easyMarkets Advantage | easyMarkets Disadvantage |

|---|---|

| Fast digital deposits, including Neteller, and Credit Cards | None |

| Fast digital deposits, including Neteller, and Credit Cards | |

| Multiple Account Base Currencies | |

| 0$ deposits and free withdrawals | |

| Withdrawal requests are confirmed within 12-24 hours |

Deposit options

Easy Markets offers a huge selection of payment methods for traders to make deposits into their trading accounts. The multiple payment funding makes their options with numerous ways available in almost any region including bank transfer, credit and debit cards, online cards and a selection of eWallets: Sofort, giropay, iDeal, WebMoney, BPAY, Neteller and fasapay.

EasyMarkets minimum deposit

EasyMarkets minimum deposit requires 100$ as a start, while a bigger size account along with VIP and premium conditions demands higher balance maintenance.

EasyMarkets minimum deposit vs other brokers

| easyMarkets | Most Other Brokers | |

| Minimum Deposit | $100 | $500 |

Withdraw fee

EasyMarkets does not charge any fees to fund or withdraw money from your account. The fees are covered for all EasyMarkets payment methods, including debit cards, credit cards and bank transfers. However, it is important to check with your payment provider in case they will waive their own fees.

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

How do I withdraw money from easyMarkets?

You can access your EasyMarkets Funds Management by logging into your account and clicking on the ‘My easyMarkets Funds Management’ tab.

If you have funded your account with a credit or debit card, the funds will be returned to the same card.

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

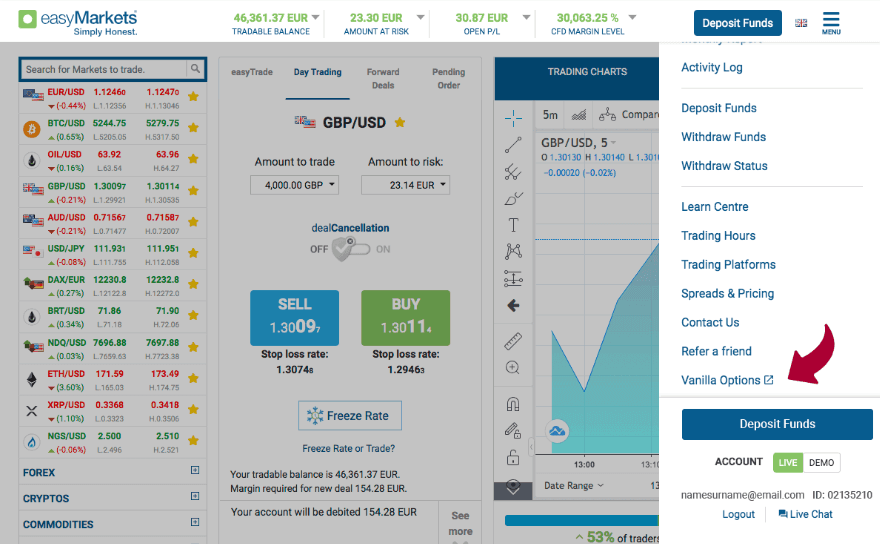

Easy Markets Trading Platforms

The easyMarkets platform is an award-winning intuitive Web-based platform that does not require installation. It’s adjusted to your computer’s system and comes with a suite of comprehensive tools to support trading. With its powerful trading conditions, the easyMarkets platform is a good option for trading.

The easyMarkets app also allows you to trade on any iOS or Android device, giving you access to markets anywhere and anytime.

EasyMarkets has an overall rating of 8.4 out of 10 compared to over 500 other brokers—we mark it as excellent because it’s one of the best proposals we saw in the industry and has a great range including MT4 and MT5. It also provides its sophisticated proprietary EasyMarkets platform.

Trading Platform Comparison to Other Brokers:

| easyMarkets Advantage | easyMarkets Disadvantage |

|---|---|

| Fast digital deposits, including Neteller, and Credit Cards | None |

| Fast digital deposits, including Neteller, and Credit Cards | |

| Multiple Account Base Currencies | |

| 0$ deposits and free withdrawals | |

| Withdrawal requests are confirmed within 12-24 hours |

Research

The broker offers two types of trading platforms: MetaTrader4 and Easy Markets. The first one is the most popular software in the world, and it helps you to trade with ease. The second one is for those who prefer to use their own trading terminal or use a different platform. Nevertheless, if you prefer to use the most popular software MetaTrader4 it is welcomed also with the great trading conditions and customer service equipped together with Trading Central news and analysis.

In addition to the trading software, the broker constantly develops enhancing tools and delivers vast add-ons to the trading platforms. One of the unique features is easy to trade which allows one to set the custom-designed features and execute the order instantly while guessing if the price will go up or down, with the set of the maximum amount the trader is comfortable risking, potential payout, time duration, and the price rate.

And that is also presented by the availability of trading vanilla options, which allow you to hedge against volatility and perform long-term trading.

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

EasyMarkets Customer Support

Customer support is a key part of any broker, and easyMarkets’ customer support is top-notch. The broker offers multichannel customer support via Live Chat, email, and phone. The main drawback is that it isn’t operating on weekends.

EasyMarkets has an overall rating of 8.6 out of 10 from our testing team. Our expert team contacted them and got quick relevant responses.

See our find and Ranking on Customer Service Quality:

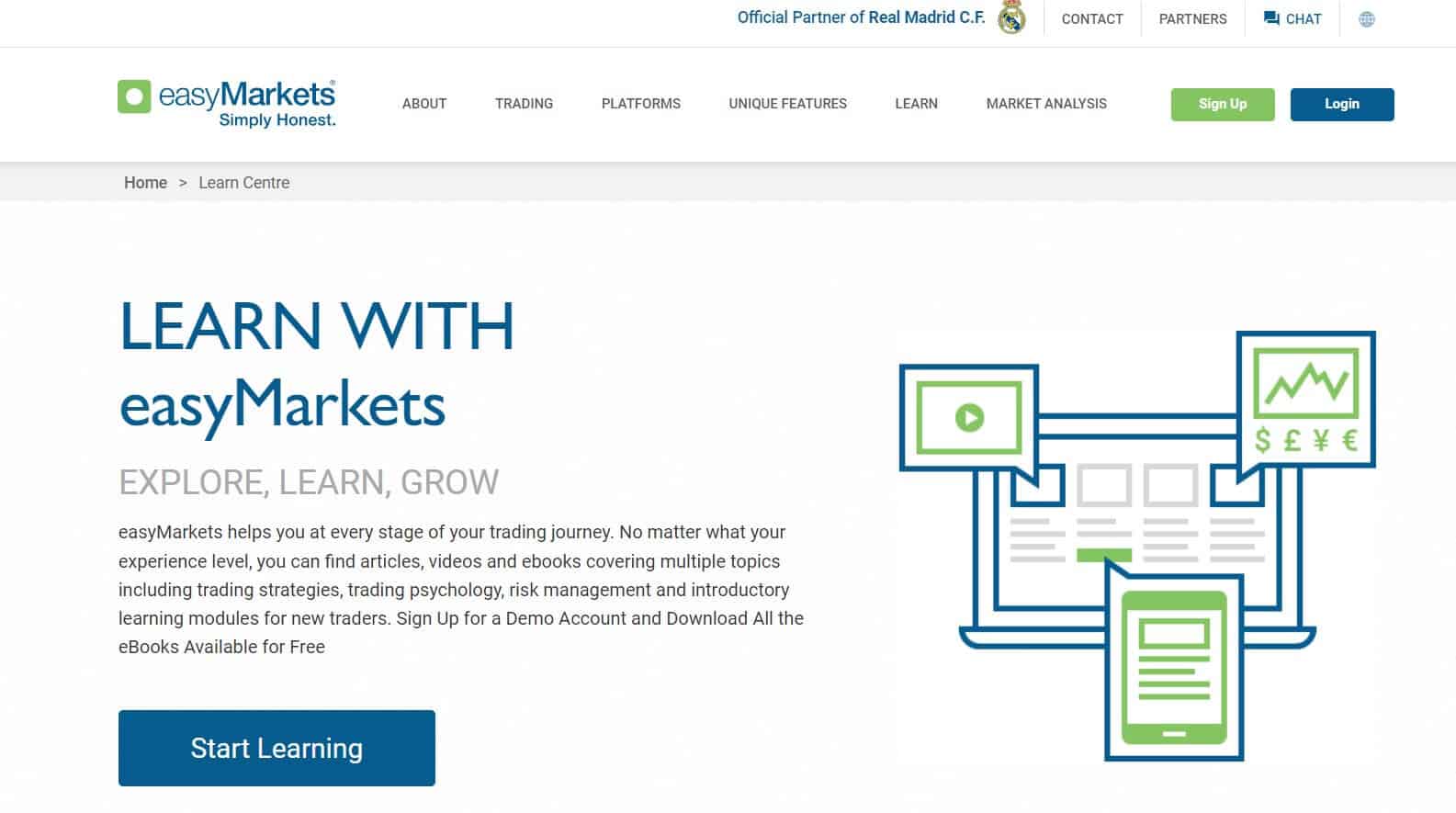

Education

In this article, we are going to talk about the easyMarkets broker and its educational program.

The first thing that we have checked is the amount of information that is provided by the broker. In fact, traders of any level can find some useful information and perform even better trading. Moreover, the broker is extremely awarded once, for the year of their operation, 37 awards were received for excellence in service, trust, and built-in technology.

EasyMarkets Education ranked with an overall rating of 7.9 out of 10 based on our research. The broker provides an extensive range of various trading educational resources suitable for both beginners and advanced traders. It provides highly useful informative courses, videos, eBooks, and glossaries

➔ Open your free trading account with easyMarkets now

(Risk warning: 75.59% of retail CFD accounts lose)

EasyMarkets Review Conclusion

Overall, our impression of easyMarkets was quite positive despite some small disadvantages. EasyMarkets review shows a brokerage company with a long operational history and absolutely fair and transparent trading conditions. Even though, the easyMarkets are even proud to be a market-making broker since they ensure stable trading conditions to their client under any market conditions and even extreme volatility. The range of account types and advanced software features are also great benefits available to all easyMarkets clients, which is worth consideration.

As for regulation, and trading instruments, the broker does seem to provide a limited range, but the great conditions along with tight spreads and low trading costs make it demanded broker among beginners and advanced traders alike.

Based on Our findings and Financial Expert Opinion easyMarkets is Good for:

- Beginning Traders

- Professional Traders

- Algorithmic or API Traders

- EAs running

- Copy Trading

- Scalping / Hedging Startegies

- Traders who prefer MT4 or MT5 platform

- Currency Trading and CFD Trading

- Suitable for a Variety of Trading Strategies

So, overall we conclude that easyMarkets can be trusted and it offers quite comfortable conditions and continues to develop and enlarge its offerings. As we see before broker had less suitable conditions, but now it thrives with its innovative technology and great offerings.

EasyMarkets is a strong player in the online trading market. It has a lot of positive feedback from its customers who say that they have never encountered any problems with this broker. The platform is very easy to use, it has a well-developed infrastructure and offers a wide range of financial instruments for trading on various markets.

IC Markets & Tickmill

| BROKER: | REVIEW: | ADVANTAGES: | FREE ACCOUNT: |

|---|---|---|---|

1. IC Markets  |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

2. Tickmill  |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

Pepperstone & Capital.com

| BROKER: | REVIEW: | ADVANTAGES: | FREE ACCOUNT: |

1. PEPPERSTONE |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

2. Capital.com  |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

Top FX & HFM

| BROKER: | REVIEW: | ADVANTAGES: | FREE ACCOUNT: |

1. TOP FX |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

2.HFM  |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

AMarkets & FXTM

| BROKER: | REVIEW: | ADVANTAGES: | FREE ACCOUNT: |

1. AMARKETS |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

2.FXTM  |

(5 / 5) (5 / 5)➔ Read the review |

# Spreads from 0.0 pips # No commissions # Best platform for beginners # No hidden fees # More than 6,000 markets |

|

| wdt_ID | # | Broker | Website | Forex Broker | Year | Regulation |

|---|---|---|---|---|---|---|

| 1 | 1 | Open an Account | FBS | 2.009 | IFSC, CySEC, ASIC, FSCA | |

| 2 | 2 | Open an Account | EXNESS | 2.008 | CySEC, FCA | |

| 3 | 3 | Open an Account | OCTA FX | 2.008 | SVG | |

| 4 | 4 | Open an Account | INSTA FOREX | 2.007 | VI FSC, CySec | |

| 5 | 5 | Open an Account | FX OPEN | 2.008 | CySEC, FCA | |

| 6 | 6 | Open an Account | AXI | 2.008 | CySEC, FCA | |

| 7 | 7 | Open an Account | FX PRIMUS | 2.008 | CySEC, FCA | |

| 8 | 8 | Open an Account | HFM | 2.010 | CySEC, FSC, FSB, FCA, BaFin, DFSA | |

| 9 | 9 | Open an Account | FXTM | 2.011 | CySEC, FCA, IFSC | |

| 10 | 10 | Open an Account | JUST FOREX | 2.012 | IFSC | |

| 11 | 11 | Open an Account | CAPITAL.COM | 2.016 | FCA, FSA, ASIC, and CySec | |

| 12 | 12 | Open an Account | TASTY WORKS | 2.017 | CySEC, FCA | |

| 13 | 13 | Open an Account | MOOMOO | 2.018 | FINRA & SEC, SFC, MAS, ASIC | |

| 14 | 14 | Open an Account | AVATRADE | 2.006 | MiFiD, CBI, FSA, ASIC, SFB, BVI, ADGM, FSRA, CySEC | |

| 15 | 15 | Open an Account | EASY MARKETS | 2.001 | CySEC, MiFID, ASIC | |

| 16 | 16 | Open an Account | EIGHT CAP | 2.009 | ASIC, VFSC | |

| 17 | 17 | Open an Account | FP MARKETS | 2.007 | CySEC, ASIC, FSA | |

| 18 | 18 | Open an Account | HYCM | 1.977 | CySEC, FCA, MiFID, DFSA, SFC | |

| 19 | 19 | Open an Account | ICMARKETS | 2.007 | CySEC, ASIC, FSA | |

| 20 | 20 | Open an Account | IRON FX | 2.010 | FCA, ASIC, FSCA, CySEC | |

| 21 | 21 | Open an Account | LITE FINANCE | 2.007 | CySEC | |

| 22 | 22 | Open an Account | REVOLUT | 2.015 | CySEC | |

| 23 | 23 | Open an Account | IG | 1.974 | ASIC, JFSA, MAS, FINMA, FCA, FMA, CFTC | |

| 24 | 24 | Open an Account | MONETA MARKETS | 2.009 | ASIC, FCA | |

| 25 | 25 | Open an Account | AMARKETS | 2.007 | The Financial Commission | |

| 26 | 26 | Open an Account | PEPPERSTONE | 2.010 | CYSEC, BAFIN, CMA, SCB, DFSA, ASIC, FCA | |

| 27 | 27 | Open an Account | PLUS 500 | 2.008 | CySEC, ASIC, FMA, FSCA | |

| 28 | 28 | Open an Account | TICKMILL | 2.014 | FCA UK, CySEC, FSA Seychelles | |

| 29 | 29 | Open an Account | TMGM | 2.013 | ASIC, FMA | |

| 30 | 30 | Open an Account | TOP FX | 2.010 | FCA | |

| 31 | 31 | Open an Account | TRADE NATION | 2.014 | FCA | |

| 32 | 32 | Open an Account | TRADE 360 | 2.013 | CySEC | |

| 33 | 33 | Open an Account | VANTAGE | 2.009 | CIMA, SIBL | |

| 34 | 34 | Open an Account | VT MARKETS | 2.015 | ASIC, CIMA | |

| 35 | 35 | Open an Account | XM | 2.009 | ASIC, CySEC, IFSC | |

| # | Broker | Website | Forex Broker | Year | Regulation |